Zero Shorts on X: "@denholmrobyn How will you repair $TSLA's insolvent balance sheet w -$1.855B neg working capital *including* $905M in customer deposits & $1.5B less (net) cash than A/R? Also, pls

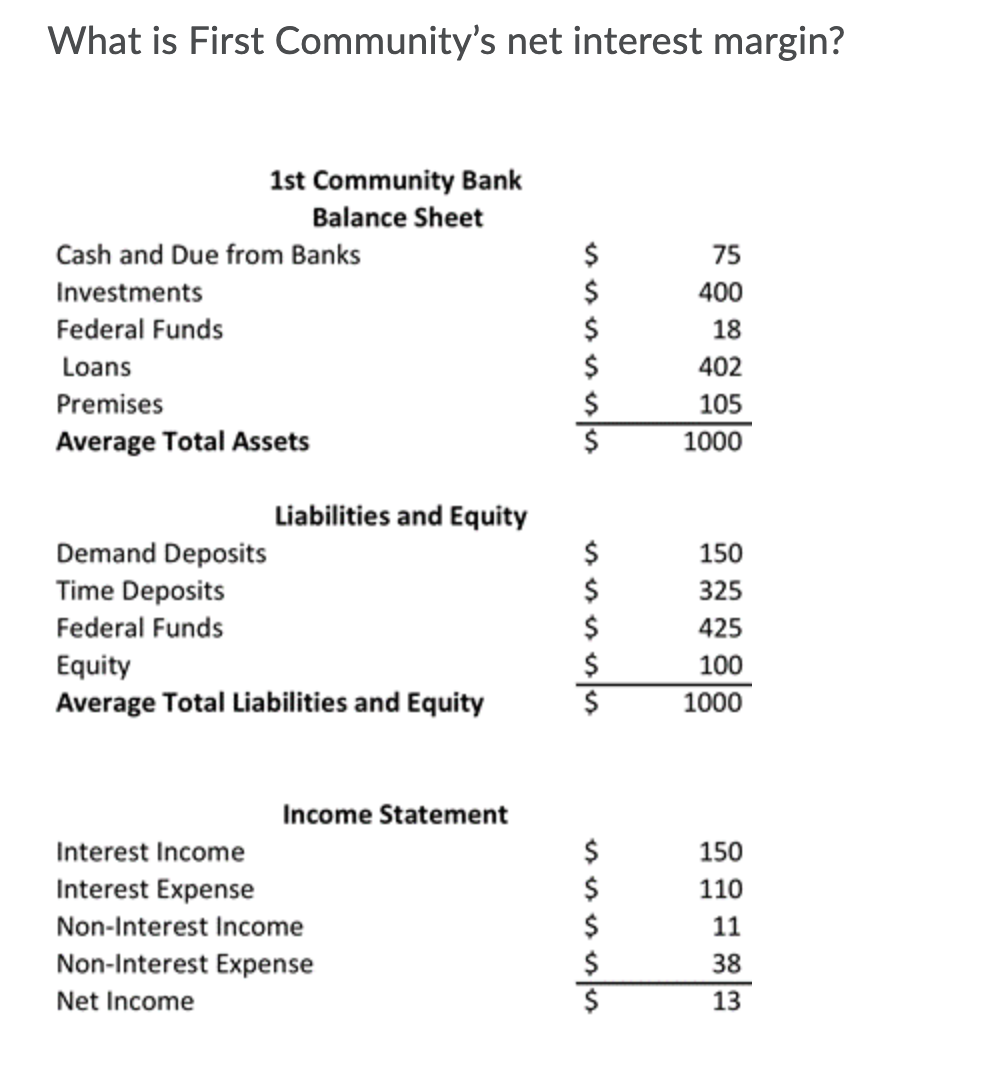

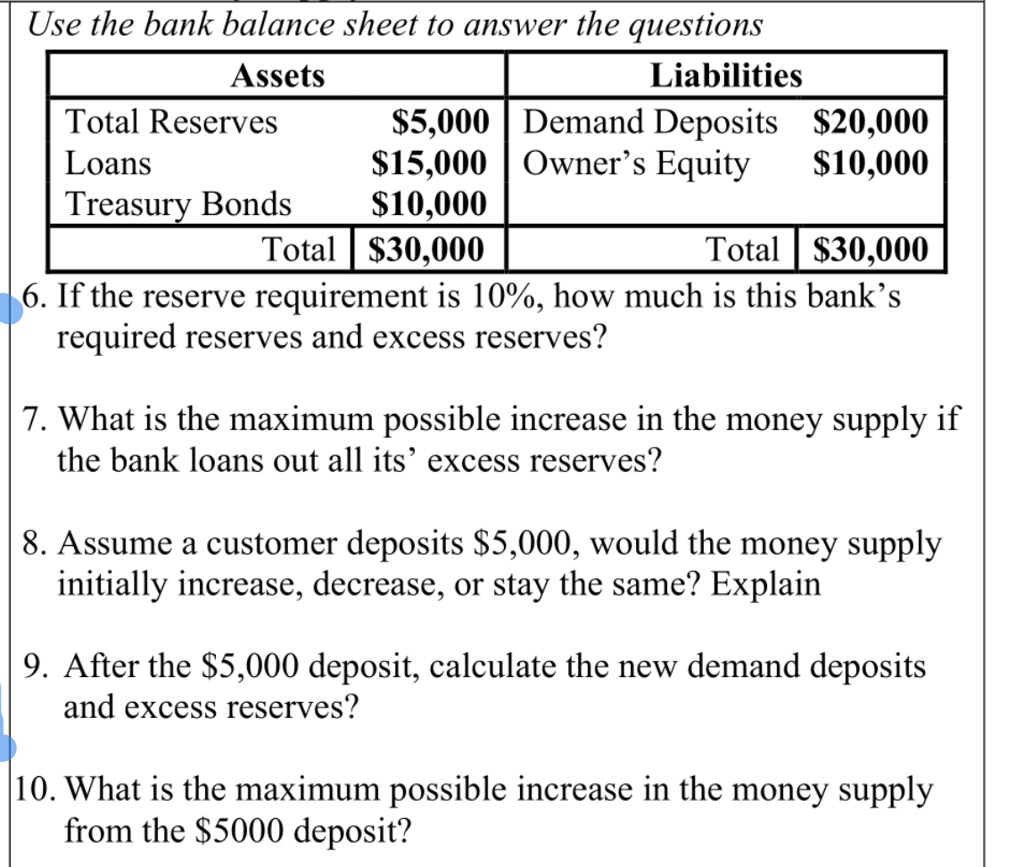

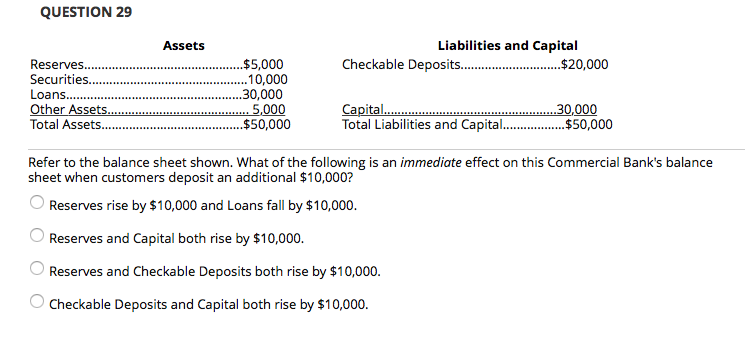

SOLVED: Use the bank balance sheet to answer the questions: Assets Liabilities Total Reserves 5,000 Demand Deposits20,000 Loans 15,000 Owner's Equity10,000 Treasury Bonds 10,000 Total30,000 Total 30,000 6. If the reserve requirement

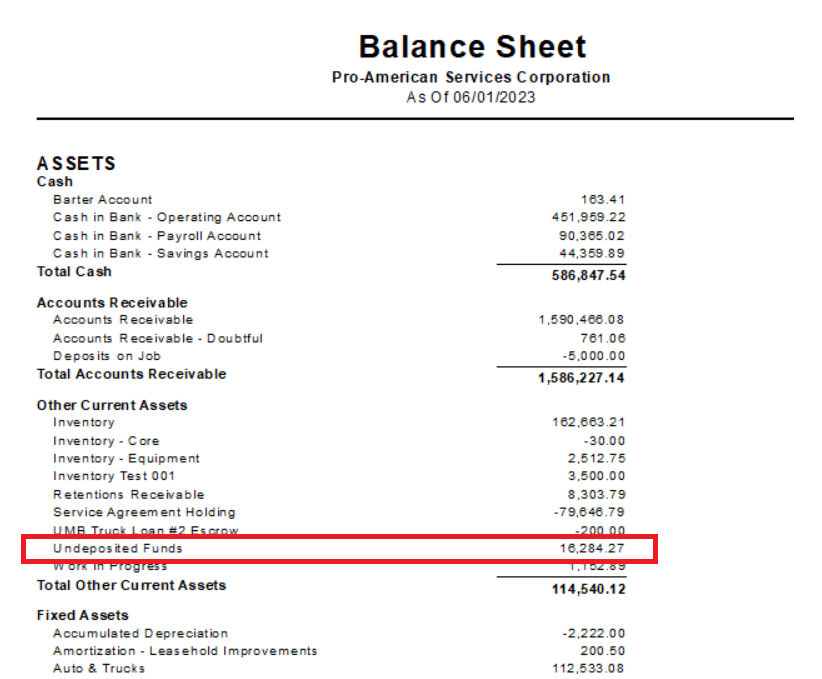

What is Undeposited Funds on the Balance Sheet? - All-In-One Field Service Management Software by Aptora -

![Economics] What is Understanding Balance sheet of a Commercial Bank Economics] What is Understanding Balance sheet of a Commercial Bank](https://d1avenlh0i1xmr.cloudfront.net/775196c2-41d1-4e4b-8375-e87ae25ac777/different-assets-and-liabilities-of-a-commercial-bank---teachoo.jpg)